rhode island income tax rate

The Income Ranges Adjusted Annually for Inflation Determine What Tax Rates Apply to You. There are no local city or county sales.

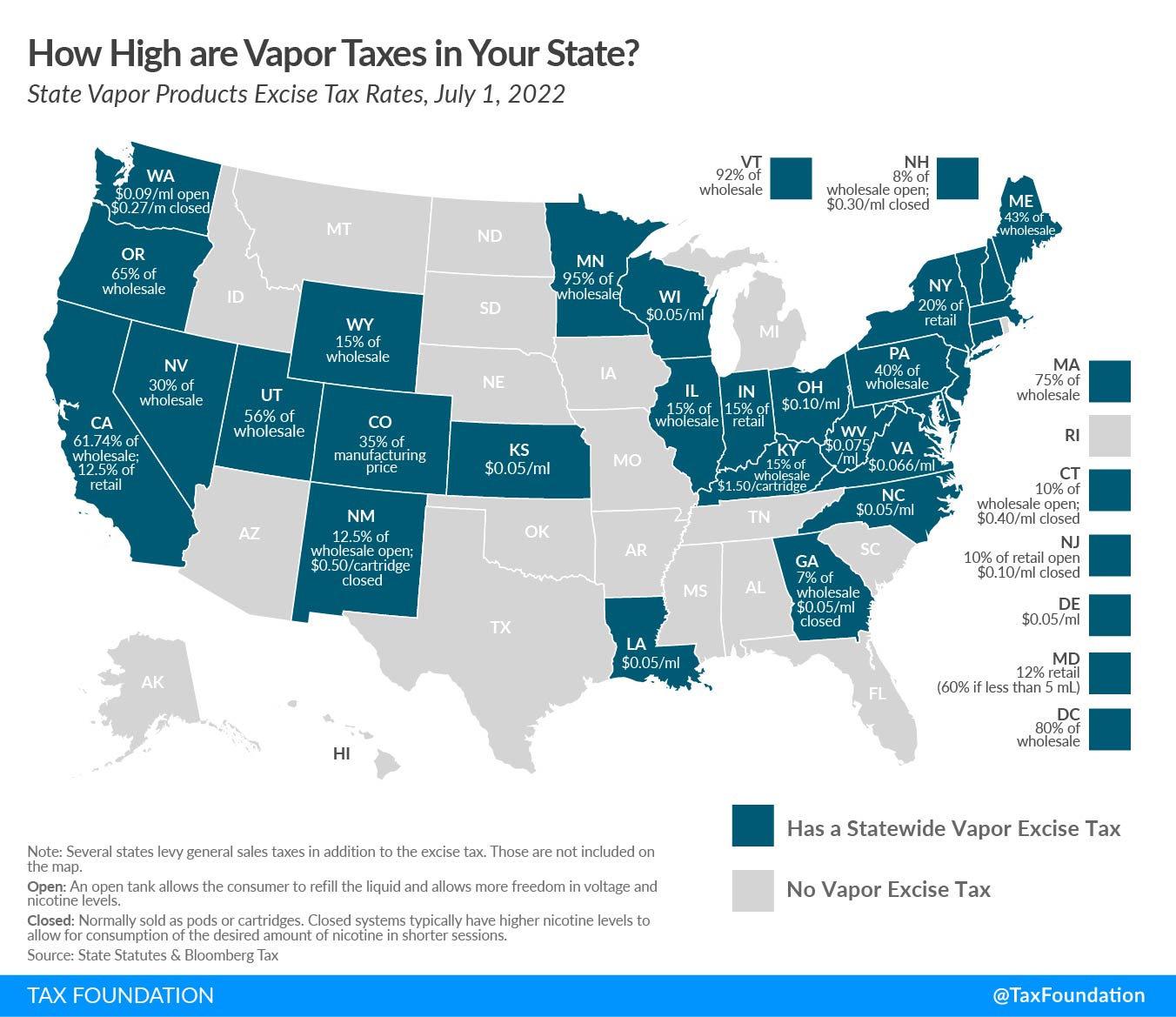

/images/2022/01/18/individual-tax-rates-by-state.png)

Here Are The States Where Tax Filers Are Paying The Highest Percentage Of Their Income Financebuzz

Rhode Island has a progressive state income tax system with three tax brackets.

. Tax rate of 475 on taxable income between 68201 and 155050. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The state now collects taxes from its residents at the following rates 2014 tax.

Complete Edit or Print Tax Forms Instantly. In a program announced by Governor McKee Rhode Island taxpayers may be. Rhode Island has a graduated individual income tax with rates ranging from 375 percent to.

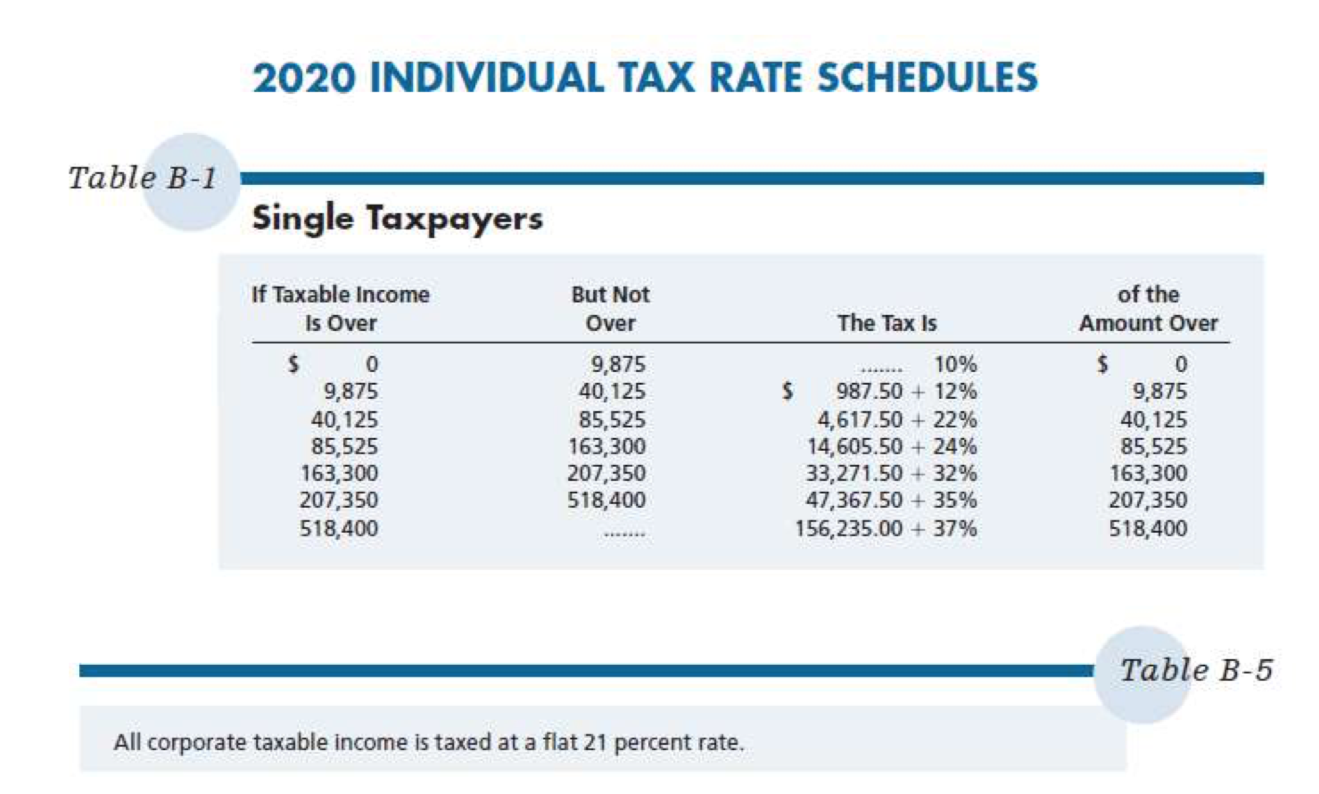

Assuming a top tax rate of 37 heres a look at how much youd take home after. Register and Subscribe Now to work on your RI DoT Form RI-1040NR more fillable forms. Income Tax Brackets Rates Income Ranges and Estimated Taxes Due.

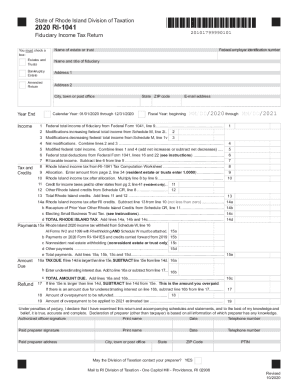

Ad Access Tax Forms. Rhode Island uses a progressive tax system with three different tax brackets ranging from 375. RHODE ISLAND TAX RATE SCHEDULE 2020 TAX RATES APPLICABLE TO ALL FILING STATUS.

If you make 70000 a year living in the region of Rhode Island USA you will be taxed 11081. Your 2022 Tax Bracket To See Whats Been Adjusted. Each marginal rate only applies to earnings within the applicable marginal tax bracket which are the same in Rhode Island for single filers and couples filing jointly.

Rhode Island Corporate Income tax is assessed at the rate of 7 of Rhode Island taxable. Complete Edit or Print Tax Forms Instantly. Rhode Island has three marginal tax brackets ranging from 375 the lowest Rhode Island tax bracket to 599 the highest Rhode Island tax bracket.

This page contains references to specific Rhode Island tax tables allowances and thresholds. Here you can find how. The interest rate on delinquent tax payments has been set at eighteen percent 18 per.

The state income tax rate in Rhode Island is progressive and ranges from 375 to 599 while. In Rhode Island the median property tax rate is 1571 per 100000 of assessed. Less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7.

In a program announced by Governor McKee Rhode Island taxpayers may be. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of. The sales tax rate in Rhode Island is 7.

Ad Compare Your 2023 Tax Bracket vs. Ad Access Tax Forms.

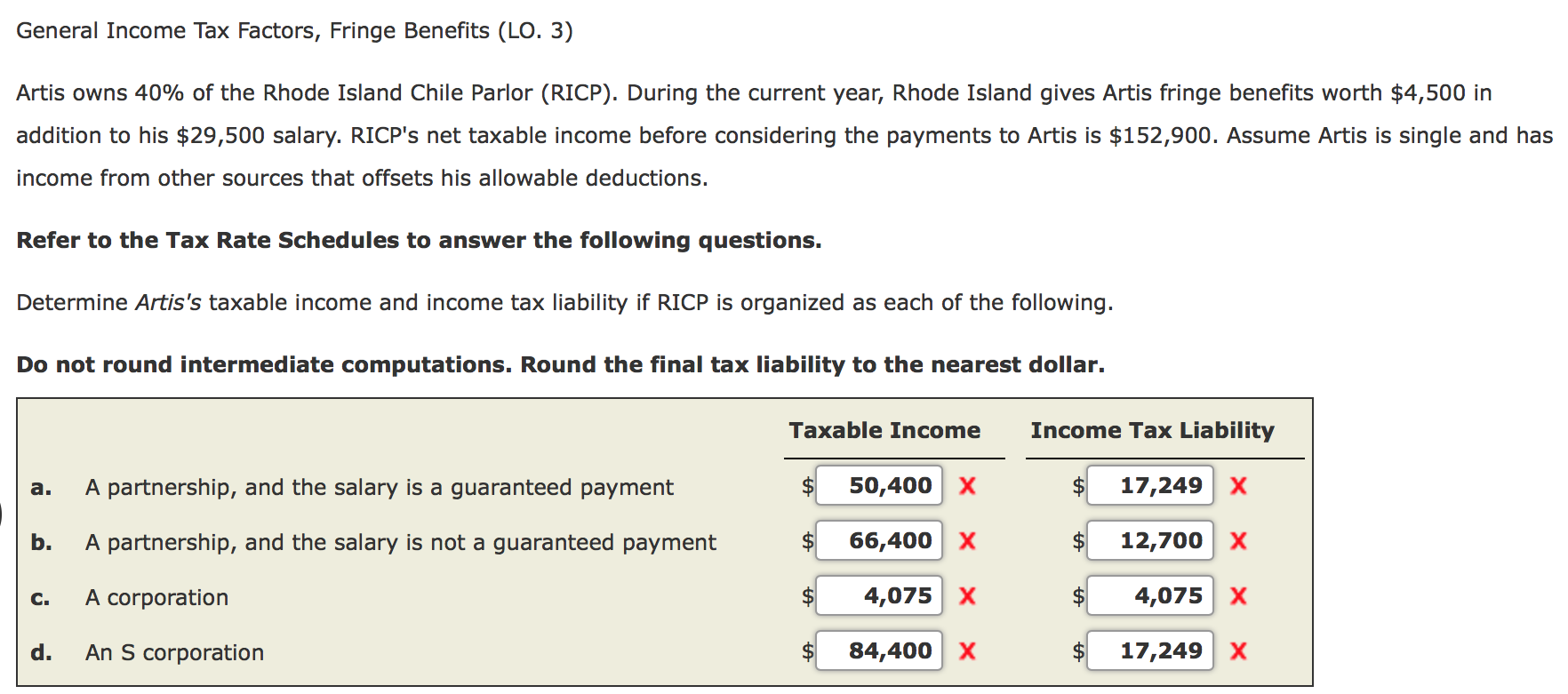

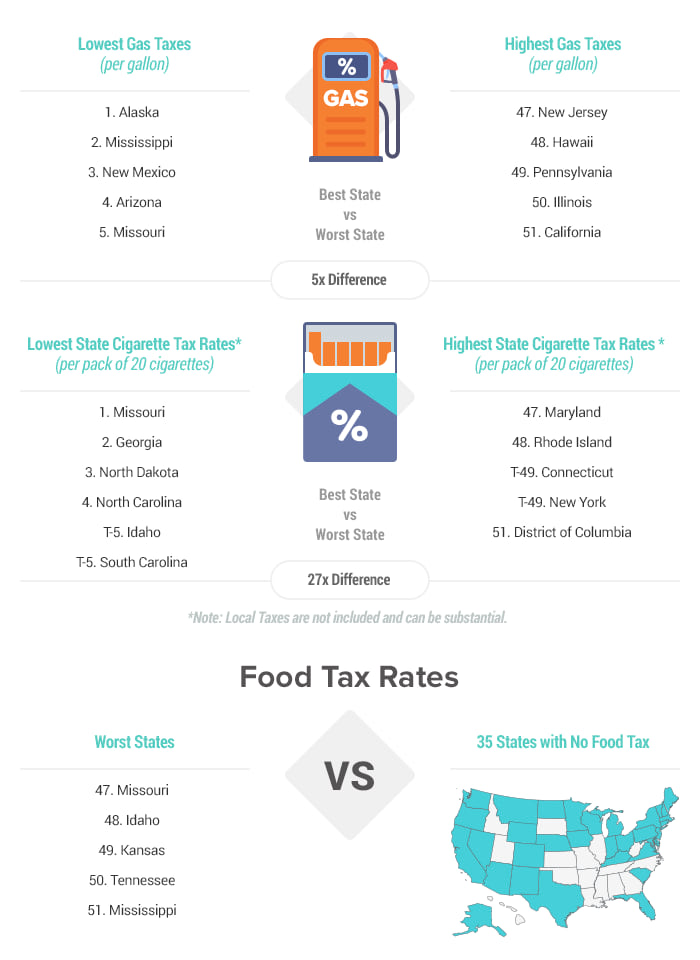

General Income Tax Factors Fringe Benefits Lo 3 Chegg Com

Golocalprov Coalition Led By Unions Launching Campaign To Increase Tax On Top 1 In Rhode Island

Form Ri 1040c Rhode Island Division Of Taxation

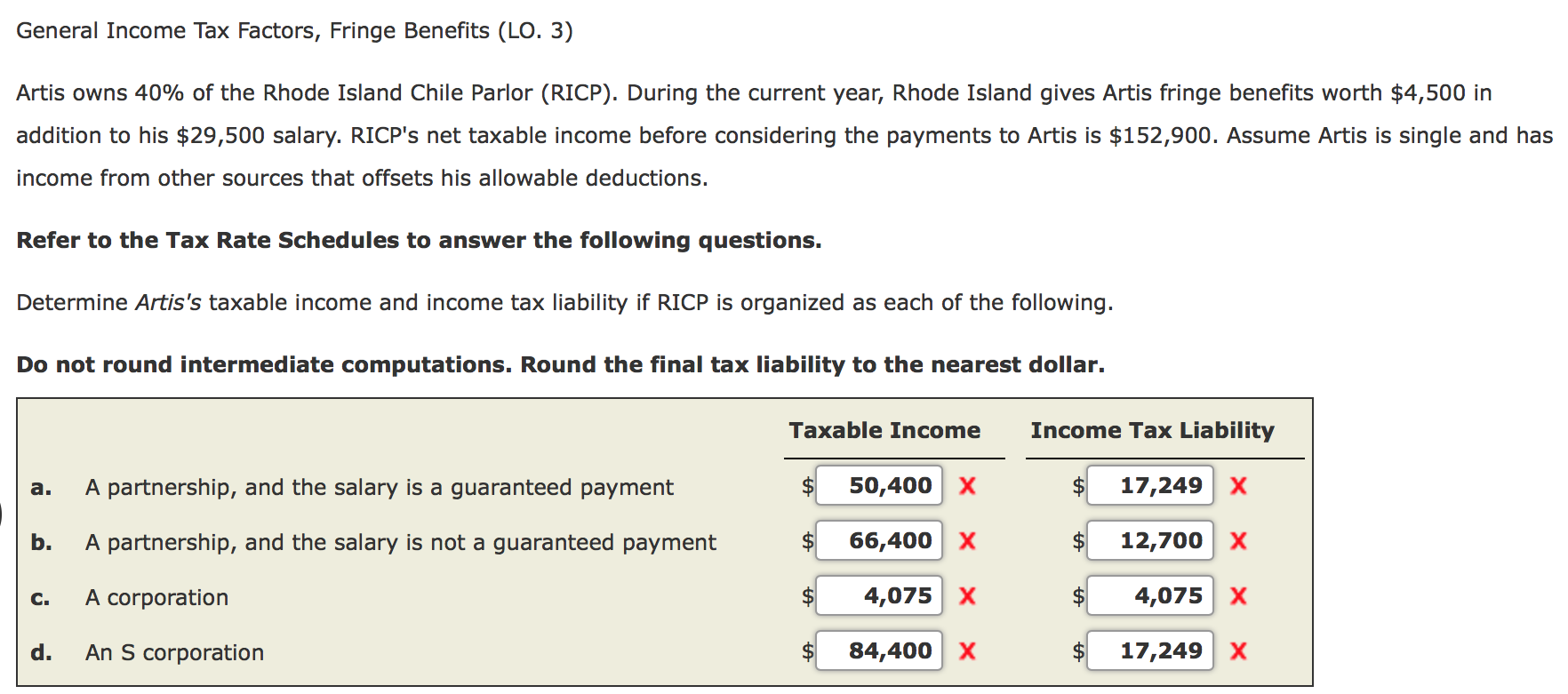

States With The Highest Lowest Tax Rates

Rhode Island Tax Rates Rankings Ri State Taxes Tax Foundation

Fiduciary Income Tax Forms Rhode Island Division Of Taxation Fill Out And Sign Printable Pdf Template Signnow

Rhode Island Income Tax Ri State Tax Calculator Community Tax

General Income Tax Factors Fringe Benefits Lo 3 Chegg Com

Top Personal Income Tax Pit Rates In The 50 States In 2004 And 2005 Download Table

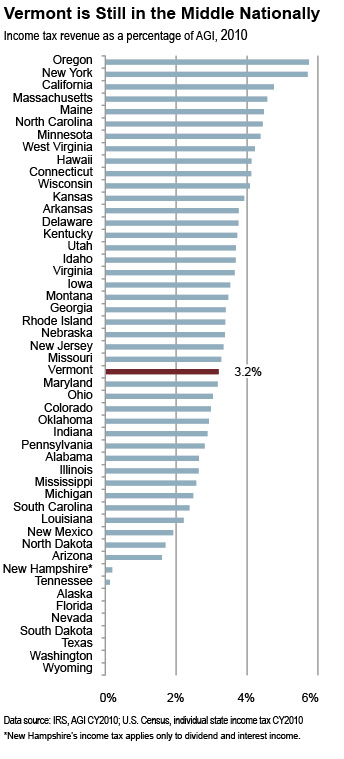

Vermont S Effective Income Tax Rate Dropped In 2010 Public Assets Institute

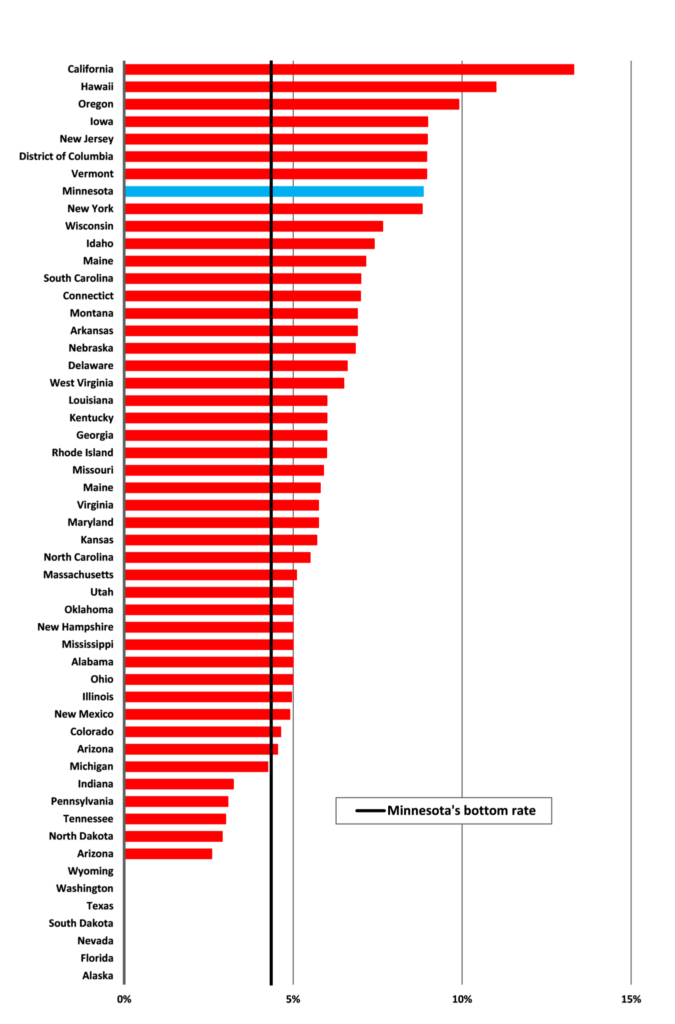

Minnesota Should Reduce Its Individual Income Tax Rates American Experiment

Tax Policy States With The Highest And Lowest Taxes

Top States For Business 2022 Rhode Island

How To Form An Llc In Rhode Island Llc Filing Ri Swyft Filings

Rhode Island Income Tax Ri State Tax Calculator Community Tax