nebraska sales tax calculator by address

Find your Nebraska combined state. Sales tax calculator and tax rate lookup tool Enter your US.

Get Your 2022 2023 Nebraska State Income Tax Return Done

51 rows Form Title Form Document Nebraska Tax Application with Information Guide 022018 20 Form 55 Sales and Use Tax Rate Cards Form 6 Sales and Use Tax Rate Cards.

. Demonstration of Filing State and Local Sales and Use Taxes Form 10 - Single Location Current Local Sales and Use Tax Rates. Nebraska has a 55 statewide sales tax rate but. Filing Tips NebFile for Business Sales and Use Tax.

Grand Island NE Sales Tax Rate. For example lets say that you want to purchase a new car for 60000 you would. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with.

Contact Nebraska Taxpayer Assistance at 800-742-7474 NE IA or 402-471-5729. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023. You can calculate the sales tax in Nebraska by multiplying the final purchase price by 055.

The average cumulative sales tax rate in the state of Nebraska is 605. Nebraska state sales tax rate range 55-75 Base state sales tax rate 55 Local rate range 0-2 Total rate range 55-75 Due to varying local sales tax rates we strongly recommend. Sales Tax Rate Finder.

Just enter the five-digit zip. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. To register for your sales tax license manually complete the first page and the Sales Use Tax portion of the Nebraska Tax Application Form 20 and mail or fax it to the Department of.

The base state sales tax rate in Nebraska is 55. The Nebraska Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Nebraska in the USA using average Sales Tax Rates andor specific Tax Rates by. Request a Business Tax Payment Plan.

L Local Sales Tax Rate. The Nebraska state sales and use tax rate is 55 055. Sales and Use Tax.

The Nebraska state sales and use tax rate is 55 055. Sr Special Sales Tax Rate. Determine Rates - Or - Use my current location Why cant I just use.

The current sales tax rate in Nebraska is 55. Gering NE Sales Tax Rate. Hastings NE Sales Tax Rate.

S Nebraska State Sales Tax Rate 55 c County Sales Tax Rate. ArcGIS Web Application - Nebraska. Businesses that make taxable purchases for resale manufacture or processing must pay a use tax instead of sales tax.

Make a Payment Only. So whilst the Sales Tax Rate in Nebraska is 55 you can. This includes the rates on the state county city and special levels.

The average cumulative sales tax rate in Lincoln Nebraska is 719 with a range that spans from 55 to 725. Form 10 and Schedules for Amended Returns and Prior Tax Periods. Fremont NE Sales Tax Rate.

Sales and Use Tax Online Filing Frequently Asked Questions. Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75. Address below and get the sales tax rate for your exact location.

This takes into account the rates on the state level county level city level and special level.

11 9 Sales Tax Calculator Template

Sales Tax Calculator And Rate Lookup Tool Avalara

Property Tax Calculator Estimator For Real Estate And Homes

Nebraska Sales Tax Calculator And Local Rates 2021 Wise

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

How To File And Pay Sales Tax In Nebraska Taxvalet

Nebraska Income Tax Calculator Smartasset

States With The Highest Lowest Tax Rates

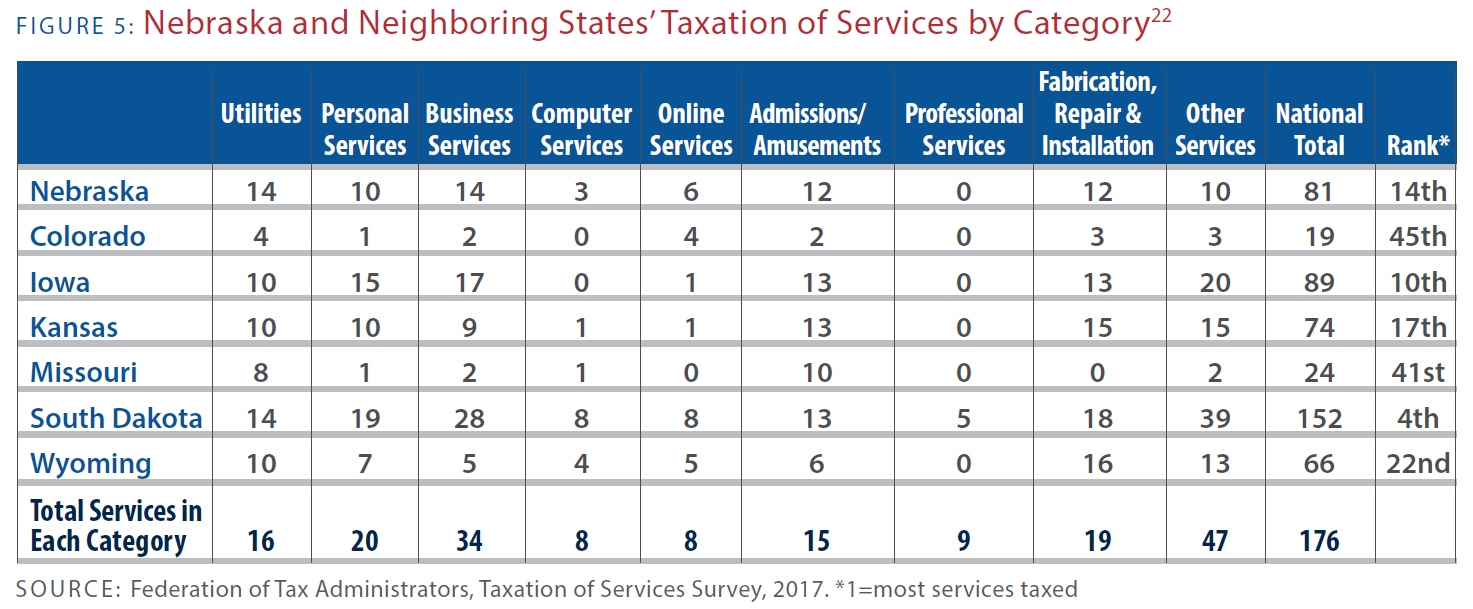

Taxes And Spending In Nebraska

Sales Tax Calculator And Rate Lookup Tool Avalara

Car Tax By State Usa Manual Car Sales Tax Calculator